How does Coinbase make money

Are you curious about how does Coinbase make money? There is no doubt that Coinbase is one of the largest exchanges in terms of the number of users and trading volume. It is also the owner of two cryptocurrency brokerages that operate in the cryptocurrency area: Global Digital Asset Exchange (GDAX) – an exchange for professionals; and Coinbase Commerce – a platform that allows merchants and consumers to transact business with each other. Coinbase is fully backed by many venture capital firms, including Andreessen Horowitz, one of the most successful VC firms today.

So how does Coinbase work? And how does it generate its revenue?

Coinbase: Company Profile

What is Coinbase?

Located in San Francisco, California, Coinbase is a digital currency exchange specializing in digital currencies. The company offers exchanges of Bitcoin (BTC), Bitcoin Cash (BCH), Ether (ETH), and Litecoin (LTC) with fiat currencies in 32 countries, as well as Bitcoin transactions and storage in 190 countries around the world. There are no limitations to where you can use it as long as you have an internet connection.

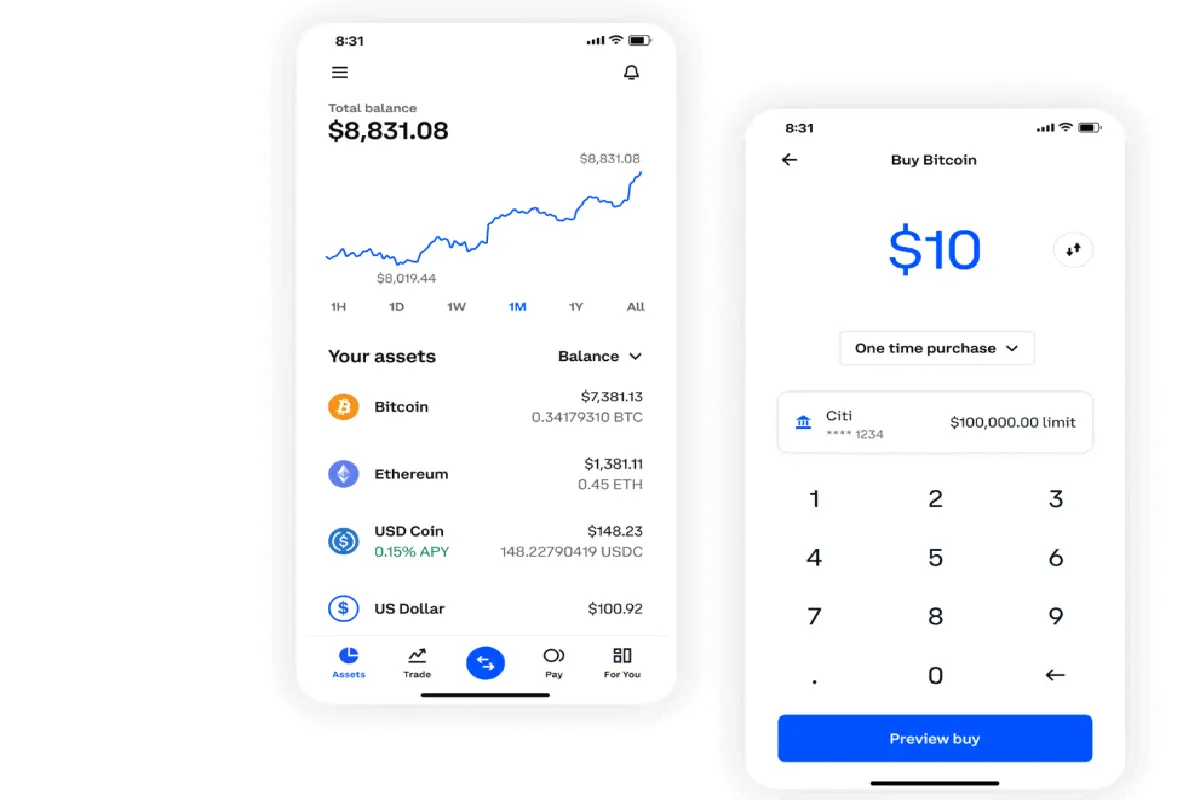

Using the Coinbase app, users can trade cryptocurrencies via mobile phones or computers and buy and sell cryptocurrencies. Also, Coinbase allows its users to send digital currency to other Coinbase customers for free and to purchase goods and services from merchants that accept cryptocurrencies as payment.

As one of its features, Coinbase offers a digital wallet in which a user can store, send, and receive digital currencies such as bitcoins or ethers. In addition to offering cryptocurrency trades over the internet, Coinbase provides a platform where users can spend their hard-earned cryptocurrency to buy fiat currency, such as US dollars (USD).

How does Coinbase work?

To use Coinbase, you must set up a free account on the website and connect your bank account to it. Once connected, you can buy cryptocurrencies with fiat currencies such as the US dollar or euro.

The process of buying and selling cryptocurrency is called trading, which differs from investing in crypto. A trader may buy and sell quickly as the price fluctuates, while an investor might hold onto his coins over a long period in the hopes that they will increase in value over time (or fall in value as well).

In addition, you will be able to buy or sell BTC/ETH/LTC directly from your bank account or credit card—no need to worry about Bitcoin wallets or complicated setup steps. Coinbase also supports other digital assets like BCH, EOS, XRP, ADA, and XLM, as well as other cryptocurrencies.

Customers can also use the Coinbase Wallet, also referred to as the crypto wallet. It has two significant advantages over the exchange:

a) increased security because user data is stored locally on their device rather than on Coinbase’s servers;

b) the ability to transfer cryptocurrency across wallets.

The Coinbase Wallet is available as an app on Android and iOS platforms, and users can benefit greatly from it. The wallet also makes it easier to buy and sell items.

How was Coinbase started?

In 2012, Brian Armstrong and Fred Ehrsam founded the startup in San Francisco, California. Armstrong is the CEO of the company and was born in 1983 near San Jose, California, and graduated from Rice University in 2005 with a bachelor’s degree in economics and computer science. The following year, he earned his master’s in computer science.

His success as an entrepreneur earned him a place on Fortune Magazine’s list of “40 under 40” in 2013 for his success as an entrepreneur. Coinbase’s work has earned him a spot on Inc.’s 30 Under 30 list for 2014, which honors young entrepreneurs. And in 2018, Forbes magazine named him one of the “World’s 100 Most Powerful People in Business”.

Ehrsam was born in Boston on May 10, 1988, and grew up in Concord, Massachusetts. He earned his Bachelor of Science degree in computer science with a minor in economics from Duke University in 2010.

He is a top-tier entrepreneur and venture capitalist who has been an active investor in blockchain technology since 2012, when he became involved with Bitcoin. He saw its potential as a decentralized payment system allowing people to transfer value without trusting a central authority or third parties such as a bank or credit card company.

In creating Coinbase, they aimed to make understanding, using, and trading digital currencies as easy as possible. Besides, they wanted to make it easier for merchants to accept cryptocurrencies as a payment method in exchange for their goods and services.

Coinbase Offerings

The Coinbase platform was initially launched as an online wallet service where users could store cryptocurrencies such as Bitcoins and Bitcoin Cash. As of 2015, Coinbase had added support for additional cryptocurrencies, including Ripple (XRP), Ethereum Classic (ETC), ZCash (ZEC), Dash (DASH), Monero (XMR), NEO (NEO), OmiseGO (OMG), and Dogecoin (DOGE). During the first half of 2017, it added its first cryptocurrency index fund, USD Coin or USC.

Coinbase experienced rapid growth in December 2017 when Litecoin (LTC) was added as a new trading option to its platform. In June 2018, Ethereum Classic (ETC) was introduced in response to the demand from the community.

Coinbase has increased its offerings significantly over the past few years by adding several new products:

- An index fund called Coinbase Index Fund

- An over-the-counter trading desk called Coinbase Prime

- A custody service called Coinbase Custody

- An open-source software platform

Coinbase Index Fund

Coinbase Index Fund is a cryptocurrency index fund that provides investors with exposure to all of the cryptocurrencies listed on Coinbase. It aims to track the returns of the entire market by investing in all the coins in the same proportions as they appear on Coinbase’s exchange.

The fund’s holdings are weighted based on factors such as market capitalization and liquidity to track the overall performance of the cryptocurrency market.

Coinbase has set up an index fund because they believe it will help investors gain exposure to a broad swath of cryptos without worrying about whether they’re buying or selling at the right time.

Coinbase Prime

Coinbase Prime was introduced to allow users to buy and sell cryptocurrencies without fees. It is similar to the existing Coinbase Pro platform but has added features for professional traders.

To participate in the beta test of Coinbase Prime, users must go to their profile page on the Coinbase website, click “Get Started,” and then register for the beta program. Once registered, users can use their existing accounts or create new ones.

The features available on Coinbase Prime include the following:

-A dark mode that makes it easier to view charts at night

-A new charting tool that offers more information than other trading platforms

-A way to trade Bitcoin (BTC) tokens against other currencies such as Ethereum (ETH) or USDT (Tether) tokens

Coinbase Custody

Coinbase Custody is a way to store your cryptocurrencies. It’s a platform that allows users to protect and manage their digital assets through the Coinbase platform. It is an institutional-grade service storing large amounts of cryptocurrency in a highly secure environment. It’s been designed to meet the needs of large institutional clients and professional traders, but it can also be used by individual customers who want to store their cryptocurrency securely.

It is built on top of the same security architecture as GDAX, which means it’s backed by the same level of security as one of the world’s most trusted cryptocurrency exchanges.

Coinbase Statistics

Coinbase users: The company has grown tremendously over the past several years. It now boasts over 56 million users across 32 countries and has a trading volume of $335 billion per quarter.

Coinbase revenue: Since 2014, the company has grown its revenue by more than 50% annually and shows no signs of slowing down soon. Coinbase revenue skyrocketed to $7.8 billion in 2021 from $1.2 billion in 2020. As of 2022, Coinbase generated revenue of $5.69 billion.

How does Coinbase make money?

By 2021, Coinbase grew its revenue to $7.8 billion, a 524% increase from 2020. So what is Coinbase’s business model and how does the platform generate its revenue?

Coinbase’s business model includes several revenue streams. Coinbase makes money from retail users by charging of fees for transactions, the buying and selling of cryptocurrency, debit card fees, the charging of interest on credit balances, and other sources of income.

Fees for transactions

Coinbase generates a majority of its income through transaction fees. Earnings from trades are proportional to the cost and volume of exchanging one cryptocurrency for another or withdrawing funds from a wallet. The following are the current transaction fees that the platform charges:-

– If the total of your purchase is less than $10, the cost will be $0.99.

– Those with a transaction totaling more than $10 but less than or equal to $25 will be charged a $1.49 fee.

– If you’re purchasing for more than $25 but less than $50, the fee will be $1.99.

– If you’re purchasing for more than $50 but less than $200, you’ll be charged $2.99.

Fees for services (buying and selling cryptocurrencies)

Coinbase generates around 7 percent of its overall income via subscription and service fees. Coinbase’s services and subscription revenue are primarily comprised of Blockchain rewards, Custodial fee revenue (the cost to hold Crypto in its specialized cold storage solution), Campaign revenue, Interest income, and others.

Coinbase Debit Card

Coinbase also provides its customers with a debit card that can be used to make purchases with USDC. They announced that their Visa debit card would be available to other countries beginning in October 2020. Until then, the card was restricted to the British and European markets. There is no fee associated with the card, but Coinbase levies a fixed transaction fee of 2.49% on all purchases made with the card.

Additionally, those in the US who use debit cards can get cash back on purchases. The company promises a maximum return of 4% in Stellar Lumens or 1% in Bitcoin.

Interest on Credit Card Balances

If you buy a cryptocurrency using a credit card on Coinbase and then withdraw the cryptocurrency to your bank account, Coinbase will charge you a fee for the withdrawal. The fee you pay is because they make it easier for you to use your borrowed money to purchase the cryptocurrency of your choice.

Additionally, Coinbase provides USD loans from itself or its affiliates. When a customer takes out a loan through Coinbase, the exchange takes their bitcoins as security and sells them for a fee. Users are charged a fixed fee of 2% of the total transaction amount.

Other revenue streams:-

Coinbase’s revenue sources include the revenue earned when it acts as the principal in a cryptocurrency asset sale. Customers who keep their cryptocurrency on the Coinbase exchange can put it at “stake” to earn interest. In exchange for its services, Coinbase receives a 25% fee from each successful transaction before distributing the funds.

Additionally, if user orders do not reach the minimum transaction size for execution on its platform or if Coinbase needs to maintain its customers’ trade execution and processing timeframes during unanticipated system outages, Coinbase will keep custody of a small number of cryptocurrencies.

The fees associated with Coinbase’s wallet service for sending cryptocurrency payments are lower than those associated with other cryptocurrency wallets.

Final thoughts

Coinbase is one of the leading financial institutions in the united states. Having been founded in 2012, it is a seasoned veteran in the financial services sector that has enjoyed widespread success, ranking among the top US exchanges, and is backed by several top venture capitalists. Currently, Coinbase provides consumers with a simple and convenient way to buy and sell digital currency, and the service is available in 32 countries worldwide.

The company’s mission was to create an open financial system for users worldwide and make it more accessible. With this goal in mind, Coinbase has built a global exchange platform that makes it easy for anyone to convert digital currency into local currency or vice versa.