The Carvana Business Model: How does Carvana make money?

Carvana provides a better way to buy a car by providing an option to browse used cars online and get financing to purchase your car. Carvana makes money by earning a profit on its used car sales and by lowering infrastructure costs. It does this by centralizing its inventory in low cost areas and eliminating the need for physical dealers, reducing their fixed costs and passing on the cost savings to the end consumer.

Carvana: Company Profile

Let’s look in depth at Carvana, how does Carvana make money and the Carvana business model.

What is Carvana?

Carvana, also known as the Amazon of Cars, is an online used car ecommerce platform which operates in the the United States market. It provides an intuitive and convenient platform to buy and finance your car. Using this platform, Customers can shop more than 25,000 vehicles, trade in their current vehicle, finance their purchase and schedule delivery or pickup at one of Carvana’s patented, automated Car Vending Machines.

- Founded – 2012

- Founder(s) – Ernest Garcia III, Ryan Keeton, Ben Huston

- CEO – Ernest Garcia III

- Headquarters – Tempe, Arizona

- Type – Public

- Industry – E-Commerce – Car dealer

- Competitors – CarGurus | Autotrader | Vroom | Cars.com | AutoNation | eBay | CarMax

How was Carvana started?

Carvana was founded in 2012 in Tempe, Arizona by Earnest Garcia III, Ryan Keeton and Ben Huston with the mission to change the way people buy cars. Ernest Garcia III, the Chief Executive Officer earned his bachelor’s degree in Management Science and Engineering from Stanford in 2005.

Ryan Keeton, the Chief Brand Officer, earned a B.A. in English and American Literature and Language from Harvard University. Ben Huston, the Chief Operating Officer, holds a J.D. from Harvard Law School and a B.A. in American Studies from Stanford University.

Garcia III is the son of Garcia II who had pled guilty in a bank fraud charge related to his dealings with Lincoln Savings & Loan. He was sentenced to three years of probation, agreeing to cooperate with the U.S. government’s investigations and filed for bankruptcy protection.

Garcia II then tried to make a comeback with Ugly Duckling, a bankrupt rent-a-car franchise he bought for less than $1 million. Although he couldn’t turn the business around, he merged it with his fledgling finance company that sold and financed used cars for people with poor credit histories.

Garcia then took the company public and raised $170 million. When Ugly Duckling’s stock price crashed from $25 to $2.50, Garcia bought the shares he didn’t own for $18 million and took full control of Ugly Duckling, taking it private and renaming it to DriveTime Automotive.

Garcia III joined DriveTime in 2007 and built Carvana as a subsidiary of DriveTime. Initially, Carvana bought most of its used car inventory from Drivetime, although later, DriveTime spun off Carvana.

Carvana which went public in 2017, no longer purchases its inventory from DriveTime. To keep Carvana out of controversy, Garcia II did not join Carvana as its director or officer. However, he still remains Carvana’s largest shareholder.

The idea for Carvana was cemented in Garcia III’s mind when he was at a wholesale auction where dealers bought cars for selling them to customers. Garcia noticed that though there were people from multiple dealerships buying cars, it took no more than 30 seconds for them to decide and buy a car.

Garcia was inspired in that moment and he wanted to take the same experience directly to customers. Carvana was started with the idea that selling a used car could be done faster, with lower costs as well be a fun experience for the end customer.

How does Carvana work?

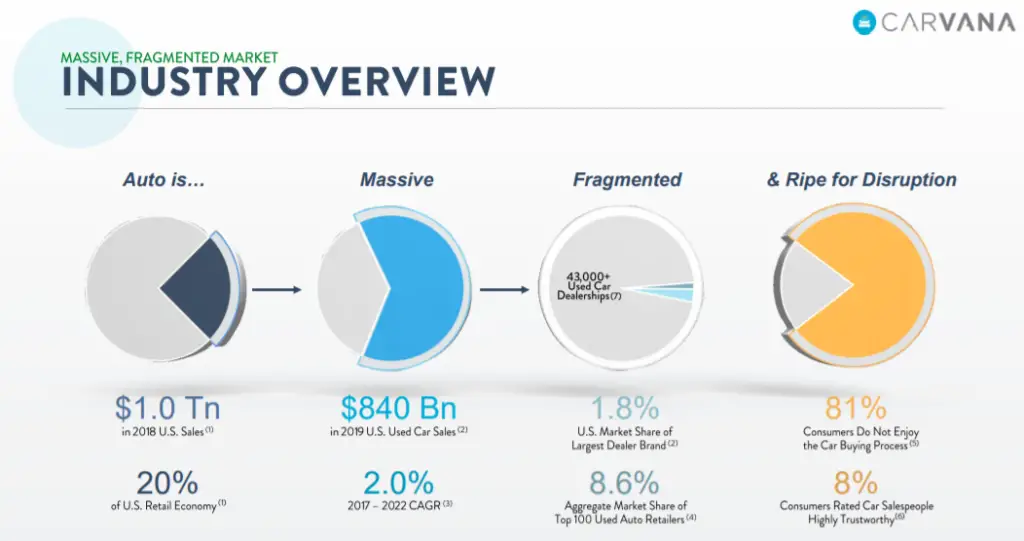

The used car market in the United States is $840B. This is a highly fragmented market and the largest dealer brand holds only a 1.8% market share.

The whole used car buying experience from a traditional car dealership is far from pleasant. It is a time consuming process, compounded by factors such as pushy used car salesmen, shady dealers and the fear of paying for an overpriced, defective car. Carvana is different. Carvana has changed the paradigm for customers in terms of how they think about purchasing used cars.

To use Carvana all you have to do is go to the Carvana app or the home page and search for cars. You can filter by the criteria you are interested in for a car, for example by the the price, body type, make and model, year and mileage, color and myriad of other features that appeal to you. Once you’ve narrowed in on your list of choices, you can click on a car to get the details about the vehicle.

From the details tab, you can inspect the car and features with Carvana’s patented 360-degree photo technology and even take it for a virtual spin. The details tab gives you all the specifics of the vehicle and you also get access to a free CARFAX vehicle history report. You can also view how the vehicle fares on Carvana’s 150 point inspection report, so that you are reassured about the quality and safety of your purchase.

If the purchase has already been started by some other buyer, you will be notified that the purchase is pending. You can also set up alerts for vehicles to get notified if they become available to purchase. You can save cars as Favorites as well to short list them for purchase.

Finally, you can view the list price and the total price which includes taxes, title and registration. You can also view if the car is eligible for free shipping.

If instead of making a full cash payment, you’d rather finance your car, you can also estimate your monthly payments based on your down payment. Carvana offers financing and you can get pre-qualified for a loan in just 2 minutes.

One you’ve decided the right vehicle for you, clicking on “Get Started” will take you to the online purchase dashboard, from where you can select your payment option either cash, Carvana financing or third party financing. Next, you can choose to apply a trade in, GAP warranty or Carvana Care extended warranty. Finally you can choose your delivery or pick up which is dependent on your location.

If you choose to get your vehicle delivered you can choose the direct delivery or the fly and drive option where Carvana will subsidize your flight for $200. Every car comes with a 7-day return period where you have money back guarantee.

However, the delivery fee is non-refundable, if you so you have to keep that in mind while you purchase the car. You can drive the vehicle up to 400 miles during the 7-day period after which an additional $1 per mile is charged. the vehicle has to be in the same condition as you received it when you are returning it.

If you decide to finance the purchase of your car through Carvana, you need to be at least 18 and have an income of at least $10K per year with no active bankruptcies.

Where does Carvana get its inventory from?

Carvana gets their inventory from auctions, partnered dealerships, trade-ins and from customers who sell their cars to Carvana, which inspects these vehicles thoroughly to ensure they meet the highest standards.

Carvana’s Growth

Carvana has had an explosive growth since launch. It sold 177,549 cars in 2019 an 89% growth over the 94,108 units sold in 2018. The annual revenue in 2019 was $3.94B, a 101.48% increase from the $1.95 revenue in 2018.

Carvana has also increased its car vending machines from 15 in 2018 to 23 in 2019, a 53% YoY growth. Carvana has steadily increased sales and expanded into more than 260 local markets in the U.S as of Q2 of 2020.

Carvana’s Statistics

Carvana’s Venture Capital Funding: According to Crunchbase, Carvana has raised a total of $1.6B in funding over 5 rounds. Carvana went public in April, 2017. with a stock at $15. Carvana’s latest funding of $600M was raised in April 2020, from a Post-IPO Equity round. Carvana is funded by Ally Financial.

Carvana’s Valuation: Carvana is valued at $33.956B.

Cars sold by Carvana: Carvana sold 177,549 cars in 2019.

Carvana’s Employees: Carvana has 3,879 employees.

Carvana’s Unique Selling Proposition

Carvana’s USP is its intuitive and easy to use platform to buy used cars. Carvana has disrupted the traditional used car buying model by removing the friction that comes with dealing with used car salesmen at a car dealership. The entire used car buying process has been made seamless with technology. You can shop for a car and get financing, all under 10 minutes.

Right from the patented 360-degree photo technology to the patented, automated car vending machines, Carvana has made shopping and delivery of cars an awesome customer experience. Additionally, customer advocates are always available to find the car that’s the best fit for you. The 7-day trial period, which allows you to try the car and return it if it’s not the right fit, is another novelty for customers. All these options give more control and transparency to the customer. By creating a company and a model that delights the customer, Carvana has emerged as the game changer in the used car space.

How does Carvana make money?

Let’s look at how Carvana makes money. The company makes money by earning a profit on its used car sales. The company has lowered its infrastructure costs by centralizing its inventory in low cost areas and eliminating the need for physical dealers, something that a traditional car dealership is unable to do. Carvana claims to reduce its fixed cost and pass on the cost savings to the end consumer. The company estimates that more than $1,000 will be the average cost savings per purchase to the end customer, while the gross profit it makes per unit is $2,852.

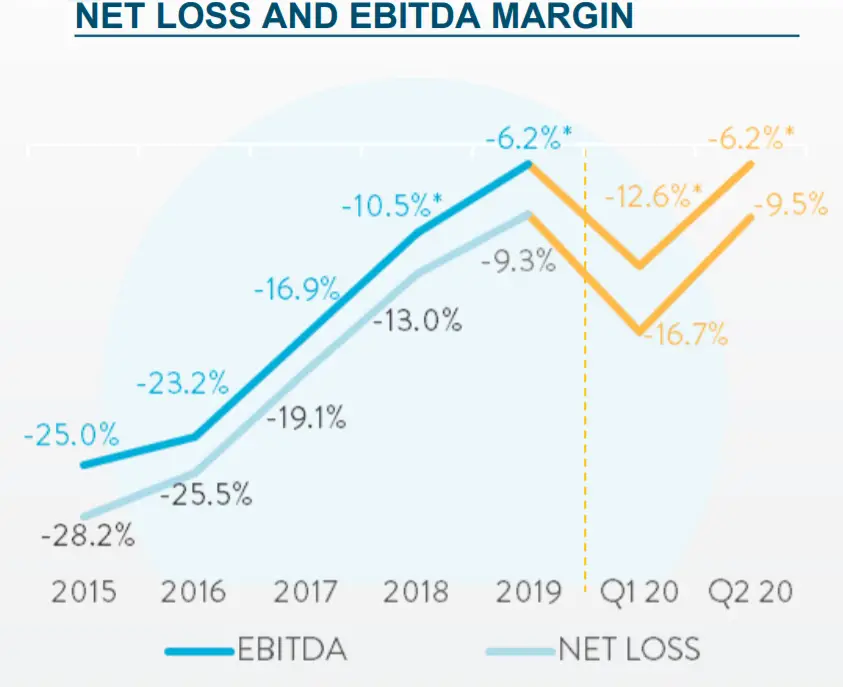

However, Carvana hasn’t yet turned a profit so far. The company has provided guidance that it will break even in Q3 of 2020. Industry analysts following the stock predict that Carvana will soon become profitable. Carvana’s shares are currently trading over $200 and the stock price has more than doubled since the end of 2019.

Final Thoughts

The COVID-19 pandemic is reshaping the purchasing behaviors of consumers. Although rental car companies, major buyers of used cars have slowed down their orders, consumers are still purchasing used cars. Shopping online has become the norm rather than the exception. As more consumers become comfortable in buying cars online, the demand is only going to grow.

As competitors such as Vroom, Shift, etc. operate in the eCommerce of automotive retails, it will be interesting to see how the new players will continue to disrupt and dominate this traditional market, provide a convenient and superior customer experience and remain profitable in the long run.

We hope this article has shed some light on Carvana’s profile, how Carvana makes money and the Carvana business model.

Other Business Models: Zelle, Craigslist, Nerdwallet, Afterpay, Zoom, OfferUp, Honey, Venmo, DoorDash, Discord, Webull, Hinge, Bumble, Vinted